Zitierweise / cite as:

Payer, Alois <1944 - >: Quellenkunde zur indischen Geschichte bis 1858. -- 14. Quellen auf Arabisch, Persisch und in Turksprachen. -- 6. Zum Beispiel: Abū 'l-Faẓl ibn Mubārak <1551 - 1602> (ابو الفضل): Ā’īn-i-Akbarī (آئین اکبری), III.5 - 14. -- Fassung vom 2008-05-16. -- http://www.payer.de/quellenkunde/quellen146.htm

Erstmals publiziert als:

Abū 'l-Faz̤l ibn Mubārak <1551-1602>: The Ā'īn- Akbarī / [by] Abū 'l-Faẓl 'Allāmī; translated into English by H. Blochmann [1838 - 1878]. -- 2nd ed. / revised and ed. by D. C. Phillott. -- Calcutta : Asiatic Society of Bengal, 1927-1949. -- 3 Bde : Ill. ; 25 cm. -- (Bibliotheca Indica ; work no. 61,270,271). -- Vol. 2-3: translated into English by H. S. Jarrett [1839 - 1919]; corrected by Jadu-Nath Sarkar. -- Bd. II, S. 46 - 77. -- Online: http://persian.packhum.org/persian/main. -- Zugriff am 2008-05-15

Erstmals hier publiziert: 2008-05-15

Überarbeitungen:

Anlass: Lehrveranstaltung FS 2008

©opyright: Public domain.

Dieser Text ist Teil der Abteilung Sanskrit von Tüpfli's Global Village Library

Falls Sie die diakritischen Zeichen nicht dargestellt bekommen, installieren Sie eine Schrift mit Diakritika wie z.B. Tahoma.

Should be a friend of the agriculturist. Zeal and truthfulness should be his rule of conduct. He should consider himself the representative of the lord paramount and establish himself where every one may have easy access to him without the intervention of a mediator. He should deal with the contumacious and the dishonest by admonition and if this avail not, proceed to chastisement, nor should he be in apprehension of the land falling waste. He should not cease from punishing highway robbers, murderers and evildoers, nor from heavily mulcting them, and so administer that the cry of complaint shall be stilled. He should assist the needy husbandman with advances of money and recover them gradually. And when through the exertions of the village headman the full rental is received, he should allow him half a biswah on each bīgha, or otherwise reward him according to the measure of his services. He should ascertain the extent of the soil in cultivation and weigh each several portion in the scales of personal observation and be acquainted with its quality. The agricultural value of land varies in different districts and certain soils are adapted to certain crops. He should deal differently, therefore, with each agriculturist and take his case into consideration. He should take into account with discrimination the engagements of former collectors and remedy the procedure of ignorance or dishonesty. He should strive to bring waste lands into cultivation and take heed that what is in cultivation fall not waste. He should stimulate the increase of valuable produce and remit somewhat of the assessment with a view to its augmentation. And if the husbandman cultivate less and urge a plausible excuse, let him not accept it. Should there be no waste land in a village and a husbandman be capable of adding to his cultivation, he should allow him land in some other village.

He should be just and provident in his measurements. Let him increase the facilities of the husbandman year by year, and under the pledge of his engagements, take nothing beyond the actual area under tillage. Should some [S. 47] prefer to engage by measurement and others by appraisement of crops, let him forward the contracts with all despatch to the royal presence. Let him not make it a practice of taking only in cash payments but also in kind. This latter is effected in several ways.

First, kankūt: kan in the Hindi language signifies grạin, and

kūt, estimate. The whole land is taken either by actual mensuration

or by pacing it, and the standing crops estimated in the balance of

inspection. The experienced in these matters say that this comes little

short of the mark. If any doubt arise, the crops should be cut and estimated

in three lots, the good, the middling and the inferior, and the hesitation

removed. Often, too, the land taken by appraisement, gives a sufficiently

accurate return.

Secondly, batāi, also called bhāoli; the

crops are reaped and stacked and divided by agreement in the presence of the

parties. But in this case several intelligent inspectors are required,

otherwise the evil-minded and false are given to deception.

Thirdly, khet

batāi, when they divide the fields after they are sown.

Fourthly, lāng batāi; after cutting the grain, they form it in heaps and divide it among themselves, and each takes his share home to clean it and turn it to profit. If it be not prejudicial to the husbandman, he may take the value of the land subject to partition of crops in cash at the market rate. If on this land they sow the best kinds of produce, in the first year he should remit a fourth of the usual assessment. If in the crops charged at special rates, the better produce is found to be larger in quantity than the previous year, but less land cultivated, and the revenue be the same, let him not be provoked or moved to contention. He should always seek to satisfy the owner of the crops. He should not entrust the appraisement to the headman of the village lest it give rise to remissness and incompetence and undue authority be conferred on high-handed oppressors, but he should deal with each husbandman, present his demand, and separately and civilly receive his dues.

He must take security from land surveyors, assessors and other officers of revenue. He should supply the officials engaged in the land measurements, for each day on which [S. 48] they are employed, with 16 dāms and 31 sers, and as a monthly ration, on the following scale:

| Flour. ser |

Oil. ser |

Grain. ser |

Vegetables &c. dām |

|

| Superintendent of survey, | 5 | ½ | 7 | 4 |

| Writer, | 4 | ½ | 4 | 4 |

| Land surveyor and four thanadars, each, | 8 | 1 | 5 | 5 |

He shall affix a mark to the land surveyed and shall take a bond from the headman that there shall be no concealment regarding the land, and the various crops shall be duly reported. In the process of measurement if any inferior portion of land be observed, he shall at once estimate its quantity, and from day to day take a note of its quality and this voucher he shall deliver to the husbandman. But if this discovery be made after the collection of the revenue, he shall gather information from the neighbours and from unofficial documents and strike an average. In the same way as the kārkun (registrar of collections) sets down the transactions of the assessments of special crops, the muḳaddam (chief village revenue officer) and the patwāri (land-steward) shall keep their respective accounts. The Collector shall compare these documents and keep them under his seal and give a copy thereof to the clerk. When the assessment of the village is completed, he shall enter it in the abstract of the village accounts, and after verifying it anew, cause its authentication by the kārkun and patwāri, and this document he shall forward weekly to the royal presence and never delay it beyond fifteen days. After the despatch of the draft estimates to the imperial court, should any disaster to the crops occur, on ascertaining the exact particulars on the spot, he shall calculate the extent of the loss and recording it in writing, transmit it without delay in order that it may be approved or a commissioner despatched. He should collect the revenue in an amicable manner and extend not the hand of demand out of season. He should begin the collection of the spring harvest from the Holi, which is a Hindu festival occurring when the sun is about to pass from Aquarius and is entering or has reached midway in Pisces, and the Autumn harvest from the Dasharah, which is a festival falling when the sun is in the middle or [S. 49] last ten days of Virgo, or the first ten of Libra. Let him see that the treasurer does not demand any special kind of coin, but take what is of standard weight and proof and receive the equivalent of the deficiency at the value of current coin and record the difference in the voucher. He should stipulate that the husbandman bring his rents himself at definite periods so that the malpractices of low intermediaries may be avoided. When there is a full harvest, he should collect the appropriate revenue and accept no adjournment of payments on future crops.

Whosoever does not cultivate land liable to taxation but encloses it for pasturage, the Collector shall take for each buffalo six dāms, and for an ox, three dāms yearly, but for a calf or a buffalo which has not yet calved, he shall make no demand. He shall assign four oxen, two cows and one buffalo to each plough and shall lay no impost on these. Whatever is paid into the treasury, he shall himself examine and count and compare it with the day-ledger of the kārkun. This he shall verify by the signature of the treasurer and placing it in bags under seal, shall deposit it in a strong room and fasten the door thereof with several locks of different construction. He shall keep the key of one himself and leave the others with the treasurer. At the end of the month, he shall take from the writer (bitikchi) the account of the daily receipts and expenditure and forward it to the presence. When two lakhs of dāms are collected, he shall remit them by the hands of trusty agents. He shall carefully instruct the patwāri of each village to enter in detail in the memorandum which he gives to the husbandman, the amount he receives from the same; any balances he shall enter under each name in a book and forward it attested by the signatures of the headmen; and these, at the next harvest, he shall recover without distress. He shall carefully inspect the suyūrghāl tenures, sending copies of them to the registry office to be compared. He should ascertain the correctness of the chaknāmah, and resume the share of a deceased grantee or one who is an [S. 50] absentee or actually in service of the state. He should take care that land cultivated by the farmer himself and not by the tenant, as well as resumed lands, should not be suffered to fall waste; the property of the absentee or of him that dies without an heir he should duly keep under ward and report the circumstances. He should see that no capitation-tax be imposed nor interfere with the remission of dues granted by former governments.

He shall not make the occasions of journeying, feasting or mourning an opportunity for exactions, and refrain from accepting presents. Whenever a muḳaddam or patwāri shall bring money or, advancing to the dais, shall present a dām in obeisance, he shall not accept it. In the same way he shall renounce balkaṭi, which is the practice of taking a small fee from each village when the harvest is ready for reaping. He shall also waive all perquisites on handicrafts, market-booths, police, travelling passports, garden produce, temporary sheds, enclosure, fishing rights, port-dues, butter, oil of sesame, blanketing, leather, wool, and the like malpractices of the avaricious who fear not God. He shall provide for the periodic appointment of one among those best acquainted with the district, to reside at the royal court and furnish it with the minutest particulars. Every month he shall submit a statement of the condition of the people, of the jāgīrdārs, the neighbouring residents, the submission of the rebellious, the market prices, the current rents of tenements, the state of the destitute poor, of artificers, and all other contingencies. Should there be no kotwāl, the Collector must take the duties of that office upon himself.

Must be conscientious, a good writer, and a skilful accountant. He is indispensable to the collector. It is his duty to take from the kanūngo the average decennial state [S. 51] of the village revenues in money and kind, and having made himself acquainted with the customs and regulations of the district, satisfy the Collector in this regard, and lend his utmost assistance and attention. He shall record all engagements made with the agriculturists, define the village boundaries, and estimate the amount of arable and waste land. He shall note the names of the munsif, the superintendent, the land-surveyor and thanadār, also that of the cultivator and headman, and record below, the kind of produce cultivated. He should also set down the village, the pergunnah and the harvest, and subtracting the deficiency take the value of the assets, or after the manner of the people of the country, inscribe the name, the kind of produce, and the deficiency below the date of cultivation.

When the survey of the village is complete, he shall determine the assessment of each cultivator and specify the revenue of the whole village. The Collector shall take the revenue on this basis, and forward a copy of the survey, called in Hindi khasra to the royal court. When drawing out the rolls, if the former documents are not available, he should take down in writing from the patwāri the cultivation of each husbandman by name and thus effect his purpose, and transmit the roll together with the balances and collections punctually, and he shall enter the name of the taḥṣildar below each village, in the day-ledger. He shall record the name of each husbandman who brings his rent and grant him a receipt signed by the treasurer. Copies of the rolls of the patwāri and muḳaddam by means of which they have made the collections, together with the sarkhaṭ, that is the memorandum given to the husbandman, he shall receive from the patwāri, and inspecting them, shall carefully scrutinize them. If any falsification appears, he shall fine them and report to the Collector daily the collection and balances of each village and facilitate the performance of his duty. Whenever any cultivator desires a reference to his account, he shall settle it without delay and at the close of each harvest he shall record the collections and balances of each village and compare them with the patwāri's, and enter each day in the ledger the receipts and disbursements under each name and heading, and authenticate it [S. 52] by the signature of the Collector and treasurer. At the end of the month, he shall enclose it in a bag under the seal of the Collector and forward it to the presence. He shall also despatch daily the price-current of mohurs and rupees and other articles under the seals of the principal men, and at the end of each harvest, he shall take the receipts and disbursements of the treasurer, and forward it authenticated by his signature. The abstract and settlement of the assessment, at the close of each year, he shall transmit under the signature of the Collector. He shall enter the effects and cattle plundered in any village, in the day-ledger, and report the circumstances. At the year's end, when the time of the revenue-collections has closed, he shall record the balances due from the village and deliver the record to the Collector and forward a copy to the royal court. When removed from office, he shall make over to the Collector for the time being his account under the heads of balances, advances &c., and after satisfying him in this regard, take the detail thereof and repair to the Court.

Currency of the means of Subsistence.

Since the benefit and vigour of human action are referrible to bodily sustenance, so in proportion to its purity is the spirit strengthened; the body, were it otherwise, would grow corpulent and the spirit weak: the thoughts too under such a regimen, incline to refinement and actions to virtue. The seekers of felicity, sober in conduct, are before all things particularly careful in the matter of food and do not pollute their hands with every meat. To the simple in heart who fear God, labour is difficult and their means of living straitened. They have not that luminous insight which penetrating to the essence of things, dwells in repose, but through fear of the displeasure of God, are sunk in exhaustion of soul from the pangs of hunger. As for instance in the case of the man who possessed a few cows, his legitimate property, and subsisted on their milk. By the accident of fortune, it chanced that they were [S. 54] carried off, and he passed some days fasting. An active fellow after diligent pursuit brought them back, but he would not accept them and replied, “I know not whence those dumb animals have had food during these past few days.” In a short space this simple soul died. Many tales are told of such dull-witted creatures who have thus passed away. There are also avaricious worldlings who do not recognize the difference between other people's property and their own, and gratify themselves at the expense of their spiritual and temporal good. The ignorant and distraught in mind, making their own necessities an occasion of spoilation and seizure, prepare for themselves eternal punishment.

Simple, innocent-minded folk consider that there are no unappropriated waste lands and were they obtainable, it would be difficult to furnish the implements of cultivation, and if these could be had, the means of providing food which would enable them to labour, are not manifest. They can discover no mine to excavate, and if one were pointed out to them which had no owner, it would be extremely onerous to obtain a living therefrom. They are averse too, from the profession of arms, lest dear life be the exchange for base lucre. They withdraw themselves also from commerce for this reason that many ask a high price for their goods, conceal their deficiencies and praise them for qualities which are not in them, while they close their eyes to the evident excellencies of what they purchase and disparage it for faults it does not possess, preferring their own benefit to another's loss. And they disapprove also of those who are content to hold lawful the sequestration of the goods of rival sectaries, and they affirm that if the fautor of such pretension be discerning and wise, it will seem an occasion for additional anxiety rather than a sanction to retain the property of another; for how can the illicit seizure of what is another's be commendable on the score of a difference of faith? On the contrary, it is a suggestion of the evil one, a phantasy of the dreams of the avaricious and unfit for the ears of the good. At the present time His Majesty has placed a lamp upon the highway before all men, that they may distinguish the road from the pitfalls, and sink not into the slough of perdition, nor pass their dear lives in unprofitableness.

Since there is infinite diversity in the natures of men and distractions internal and external daily increase, and [S. 55] heavy-footed greed travels post haste, and light-headed rage breaks its rein, where friendship in this demon-haunted waste of dishonour is rare, and justice lost to view, there is, in sooth, no remedy for such a world of confusion but in autocracy, and this panacea in administration is attainable only in the majesty of just monarchs. If a house or a quarter cannot be administered without the sanctions of hope and fear of a sagacions ruler, how can the tumult of this world-nest of hornets be silenced save by the authority of a vicegerent of Almighty power? How, in such a case can the property, lives, honour, and religion of the people be protected, notwithstanding that some recluses have imagined that this can be supernaturally accomplished, but a well-ordered administration has never been effected without the aid of sovereign monarchs. That fiery wilderness of talismanic power, too, is haunted by spells and sorcerers, and storms of confusion from this sea of undiscernment have arisen and arise, and many souls, through simplicity and shortsightedness, in the turbulent billows of inexperience have been and are still ever engulfed, while those who by the light of wisdom and through the grace of acceptance have bridled their desires and garnered provisions for the long journey to come, have, in the cross-roads of distraction, become the reproach of high and low, for their folly, irreligion and unbelief. In that assembly of ignorance should a philosopher of experience enter, he must needs take up the fashion of fools and so escape from the contumely of the base.

It is evident that in all cultivated areas, the possessors of property are numerous, and they hold their lands by ancestral descent, but through malevolence and despite, their titles become obscured by the dust of uncertainty and the hand of firmness is no longer stretched above them. If the cultivator hold in awe the power of the Adorner of the universe and the Elixir of the living, and the merchant turn back from evil designing and reflect in his heart on the favour of the lord of the world, the depository of divine grace, his possessions would assuredly be approved of wisdom. Thus the virtue of property lies in the pledge of intention, and a just ruler, like a saltbed, makes clean the unclean, and the evil good. But without honest coadjutors, abundant accessories of state and a full treasury even he could effect nothing and the condition of subserviency and obedience would lack the bloom of [S. 56] discipline. Now the man of robust frame should, in the first place, choose the profession of arms and reflect on the assistance which he is capable of rendering, so as to regard his life as devoted to the task of preserving human society from dissolution. The means of sustenance are likewise as abundant to the labourer as forage for his cattle. But if a man is unequal to this, he should endeavour, in some way, to enter into the number of state servants. Thus the currency of the means of subsistence rests on a twofold basis, viz., the justice of sovereign monarchs and regard to the welfare of well-disposed dependents. The base materialist understands not the language of reason and never transcends the limits of bodily sense. This unfertile soil needs the water of the sword, not the limpid spring of demonstration. In the presence of the majesty of the prince, the proud and perverse of disposition sink into obscurity while the prosperity of the good who seek after justice is ever continuous.

Of a truth, whatever be the recompense of the guardianship over the four priceless elements of the constitution, it is both meet and expedient and according to the Almighty will. To the watchmen over the house, the lord thereof appoints the guerdon, and to the watchmen of the universe, its shepherds. If the whole of a man's possessions were spent for the protection of his honour, it would be but fitting if in gratitude he further pledged his whole credit, how much the more when it is a question of the guardianship of the four great elements of State polity? But just monarchs exact not more than is necessary to effect their purpose and stain not their hands with avarice; and hence it is that this principle varies, as has been stated, according to diversities of age and country. From this suggestive digression, it will be evident that whatever circumspect rulers exact from their subjects after due deliberation and to subserve the interests of justice and grant to their submissive dependents, has a perfect propriety and is universally in vogue. It is also clear that the maintenance of the soldier should be ampler and more choice. Next follow the cultivators and then other artisans. [S. 57] Ancient Greek treatises affirm that professions are circumscribed to three classes, the Noble, the Base, and the Intermediate. The former refers to the mind and is, also, of not more than three kinds: the first concerns the pure intellect, as sagacity and capability of administration; the second, acquired knowledge, as composition or eloquence; the third personal courage, as military duty. The Base also is of three kinds; the first is opposed to the common weal of mankind, such as the hoarding of grain: the second is the contrary of any one virtue, as buffoonery; the third is such as the disposition is naturally averse from, as the trade of a barber, a tanner or a sweeper. The Intermediate comprises various callings and trades; some that are of necessity, such as agriculture; others which could be dispensed with, as dyeing; others again simple, as carpentry and ironmongery; and some compound, as the manufacturing of scales or knives.

From this exposition the distinguished character of the military profession is evident. In short, the noblest source of maintenance is to be found in a profession which is associated with just dealing, self-restraint and bravery and apart from evil doing and sensuality. The good regard three things as necessary in a profession—avoidance of tyranny, refraining from what is dishonourable, abstinence from all that is mean; by what is dishonourable, is meant buffoonery and the like low pursuits; by what is mean, is understood an inclination to base callings.

When an appropriate means of maintenance is secured, it is a requisite condition of economy to husband a portion of one's means, provided that the household is not thereby straitened. The mendicant should not be turned away disappointed nor subjected to the reproof of covetousness and greed. The proper control of an estate is conditional on the expenditure being less than the income; it is permitted to indulge a little in commercial speculation and engage in remunerative undertakings, reserving a part in coin and valuables, a part in goods and wares, and somewhat invested in the speculations of others, and yet a portion [S. 58] in lands and immoveable estates, and a share may be entrusted to borrowers of credit, and expenditure regulated with circumspection, justice and modesty. Let such a one be frank in his commercial dealings and give no place in his heart to self-reproach. He should keep in view of his purpose, the will of God, not the hope of gratitude, the increase of reputation or the expectation of reward. He should also give freely to the needy whose destitution is unexposed. There is also a twofold manner of munificence which if exercised in just measure, is meritorious. Firstly, what is given in pure generosity or largesse such as a present and the like. This should be done quickly and secretly and without setting store on its amplitude or abundance, nor yet so as to cripple one's resources or exhaust them.

Secondly what is called for by occasional exigencies, either in procuring comforts or removing grievances, such as what is given to oppressors or to the profligate in order that person, property and honour may escape their injury. But in this he should use moderation. In procuring the conveniences of life, however, it is better that the bounty should be liberal.

People of the world in the matter of living are to be resolved into three classes. One class are fallen into such heedlessness that spiritual needs do not enter their comprehension, much less are practically considered. Another through their luminous fortune are so immersed in the consideration of essential truths that they give no thought to their means of sustenance. But those who seek the felicity to come, the circumspect in conduct, neglect not a just appreciation of life but make external conditions the instrument of interior well being in the hope of admission among those absorbed in divine love, and so attaining to the third degree of felicity, whence after traversing the arid waste of deliverance, they may repose in the second.

The dues of sovereignty have thus been set forth. The circulation of the means of sustenance, thus, is seen to rest on the justice of prudent monarchs and the integrity of conscientious dependents. And because the conditions of [S. 59] the royal state and prerogative vary in different countries, and soils are diverse in character, some producing abundantly with little labour, and others the reverse, and as inequalities exist also, through the remoteness or vicinity of water and cultivated tracts, the administration of each state must take these circumstances into consideration and fix its demands accordingly. Throughout the whole extent of Hindustan where at all times so many enlightened monarchs have reigned, one-sixth of the produce was exacted; in the Turkish empire, Irān and Turān a fifth, a sixth, and a tenth respectively. In ancient times a capitation tax was imposed called, khirāj. Kubād disapproved of this practice, and resolved that the revenue should be fixed upon arable land accurately surveyed. But his death occurred before he could accomplish his design. Noshirwān (his son) carried it to completion and made the jarīb of ten square reeds. This was sixty royal yards square. One fourth of this was taken as a ḳafīz and valued at three dirhams, and the third part was fixed as the contribution due to the state. Ḳafīz is a measure, called also sāa' weighing eight raṭl, and, some say, more. The dirhem is equal in weight to one misḳāl. When the Caliphate fell to Omar, at the suggestion of the learned, he adopted the plan of Noshirwān but through the vicissitudes of temporal conditions, he introduced some alterations which may be gathered from ancient volumes. In Turān and Irān from ages past, they have exacted a tenth, but the exactions have increased to more than a half which does not appear exorbitant to a despotic government. In Egypt they take for a

| Faddān of the | best soil, | 3 Ibrahīmis |

| ” ” | middling, | 2 ” |

| ” ” | worst, | 1 ” |

[S. 60] The faddān is a measure of land of 100 square reeds, each of which is equal to one bāa'. An Ibrahīmi is current for 40 kabirs and 14 kabīrs is equal to a rupee of Akbar Shāh. In some parts of the Turkish empire, they exact from the husbandman 30 A´ḳchehs for every yoke of oxen. The Āḳcheh is a silver coin equal to 81 Ibrahīmis. And from crown lands the demand is 42 A´ḳcheh, and from each soldier 21, besides which the governor of the Sūbah takes 15 more. In some parts for each plough 20, and from each soldier 7 Āḳcheh, while the Governor takes six. In others, the Sanjakbegi receives 27 and the Sūbashi (kotwāl) twelve. Other systems are also given which obtain in that empire.

[...]

[S. 61] The Muḥammadans account conquered lands of 3 kinds; U'shri, Khirāji and Sulhīy. The first two are subdivided into five kinds and the last into two.

U'shri,

Khirāji

Ṣulhīy, Lands of the Bani Najrān and Bani Taghlib; the details of these may be learnt from ancient documents.

Likewise, in some treatises, land is regarded under three heads.

Tribute paid by khirāji lands is of two kinds.

Some call the whole produce of the revenue khirāj, and as the share of the producing body is in excess of their expenditure, the Zaḳāt is taken from the amount under certain stipulations and this they call a tithe, but on [S. 63] each of these points there is much difference of opinion. The Caliph Omar, during his time, taxed those who were not of his faith at the rate of 48 dirhams for persons of condition, 24 for those of the middle class, and 12 for the lowest class. This was called the Jaziyah (capitation tax).

In every kingdom government taxes the property of the subject over and above the land revenue and this they call Tamqha. In Irān and Turān they collect the land tax from some, from others the Jihāt and from others again the Sāir Jihāt, while other cesses under the name of Wajūhāt and Farūa'āt are exacted. In short, what is imposed on cultivated lands by way of quit-rent is termed Māl. Imports on manufactures of respectable kinds are called Jihāt, and the remainder Sāir Jihāt. Extra collections over and above the land tax if taken by revenue officers are Wajūhāt; otherwise they are termed Furūa'āt.

In every country such demands are troublesome and vexatious to the people. His Majesty in his wise statemanship and benevolence of rule carefully examined the subject and abolished all arbitrary taxation, disapproving that these oppressions should become established by custom. He first defined the gaz, the tenāb, and the bīgha and laid down their bases of measurement: after which he classed the lands according to their relative values in production and fixed the revenue accordingly. [S. 64]

Is a measure of length and a standard gauge. High and low refer to it, and it is the desire of the righteous and the unrighteous. Throughout Hindustan there were three such measures current, viz., long, middling and short. Each was divided into 24 equal parts and each part called Ṭassūj. A Ṭassūj of the 1st kind was equal to 8 ordinary barley-corns placed together breadthways, and of the other two respectively, to 7 and 6 barley-corns. The long gaz was used for the measurement of cultivated lands, roads, distances, forts, reservoirs and mud walls. The middling was employed to measure buildings of stone and wood, bamboo-built houses, places of worship, wells and gardens, and the short gaz for cloth, arms, beds, seats of state, sedan chairs, palanquins, chairs, carts and the like.

In some other countries, although they reckon the gaz as consisting of 24 Ṭassūj, they make

| 1 | Tassūj | equal to | 2 | Habbah (grain). |

| 1 | Habbah | ” | 2 | Barley-corns. |

| 1 | Barley-corn | ” | 6 | Mustard seeds. |

| 1 | Mustard seed | ” | 12 | Fals. |

| 1 | Fals | ” | 6 | Fatīla. |

| 1 | Fatīla | ” | 6 | Naḳīr. |

| 1 | Naḳīr | ” | 8 | Ḳitmīr. |

| 1 | Ḳitmīr | ” | 12 | Zarrah. |

| 1 | Zarrah | ” | 8 | Habā. |

| 1 | Habā | ” | 2 | Wahmah. |

| Some make 4 Ṭassūj | equal to | 1 Dāng. |

| 6 Dāng | ” | 1 Gaz. |

Others reckon the gaz as 24 fingers, each finger equal to the breadth of 6 barley-corns, and each barley-corn equal in thickness to 6 hairs from the mane of a cob. In some ancient books they make the gaz equal to two spans and twice round the joint (girih) of the thumb, and they divided it into 16 girih and each girih was subdivided into 4 parts [S. 65] which they called 4 pahr, so that a pahr was the sixty-fourth part of a gaz.

In other ancient records the gaz is reckoned of seven kinds.

Some in former times reckoned the cloth-measure (gaz) to be seven times the fist, and the fist was equal to four fingers closed; according to others, one finger less. The survey gaz, according to some, was the same seven fists: others made it seven fists together with one finger (thumb?) erect added to the seventh fist. Others again added another finger to that fist; while some made it seven fists with one finger adjoined to each fist.

Sultan Sikander Lodi in Hindustān introduced another gaz of the breadth of 41 Iskandaris and a half. This was a copper coin mixed with silver. Humayūn added a half and it was thus completed to 42. Its length was 32 digits. But some authors anterior to his time make mention of a similar measure. Sher Khān and Salīm Khān, under whom Hindustān was released from the custom of dividing the grain and its apportionment, in measuring land used this gaz. Till the thirty first-year of the Divine Era, although the Akbar Shāhi gaz of 46 fingers was used as a cloth-measure, the Iskandari gaz was used for cultivated lands and buildings. His Majesty in his wisdom, seeing that the variety of measures was a source of inconvenience to his subjects, and regarding it as subservient only to the dishonest, abolished them all and brought a medium gaz of 41 digits into general use. He named it the Ilāhi gaz and it is employed by the public for all purposes.

His Majesty fixed for the jarīb the former reckoning in yards and chose the measurement of sixty square, but adopted the Ilāhi gaz. The Tanāb (tent rope) was in Hindustān a measure of hempen rope twisted which became [S. 67] shorter or longer according to the dryness or moisture of the atmosphere. It would be left in the dew and thus fraudfully moistened. Oftentimes it would be employed in the early morning when it had got damp and had shrunk, and by the end of the day it had become dry and had lengthened. In the former case, the husbandmen suffered loss, in the latter the royal revenues were diminished. In the 19th year of the Divine era, the jarīb was made of bamboos joined by iron rings. Thus it is subject to no variation, and the relief to the public was felt everywhere while the hand of dishonest greed was shortened.

Is a name applied to the jarīb. It is a quantity of land 60 gaz long by 60 broad. Shonld there be any diminution in length or breadth or excess in either, it is brought into square measure and made to consist of 3600 square gaz. They divide the bigha into 20 parts, each of which is called biswah, and this is divided again into 20 parts each of which is termed biswānsah. In measuring they reduce no further. No revenue is required from 9 biswānsah, but ten they account as one biswah. Some, however, subdivide the biswānsah into 20 parts, each of which they called taswānsah, [S. 68] which they again divide into 20 parts, calling each tapwānsah. This again they partition in 20 portions, and name them severally answānsah. A bigha as measured by the tanāb of hemp, was two biswah and 12 biswansah smaller in extent than the bīgha measured by the tanāb of bamboo. This makes a difference of 10 bīgha in a hundred. Although the tanāb of hemp was of 60 gaz, yet in the twisting it shrunk to 56. The Ilāhi gaz was longer than the Iskandari by one biswah, 16 biswānsah, 13 taswānsah, 8 tapwānsah, and 4 answānsah. The difference between the two reduced the bīgha by 14 biswah, 20 biswānsah, 13 taswānsah, 8 tapwānsah, and 4 answānsah. In one hundred bīghas the variation in the two measures amounted to 22 bīghas, 3 bīswah and 7 biswānsah.

When His Majesty had determined the gaz, the tanāb, and the bīgha, in his profound sagacity he classified the lands and fixed a different revenue to be paid by each.

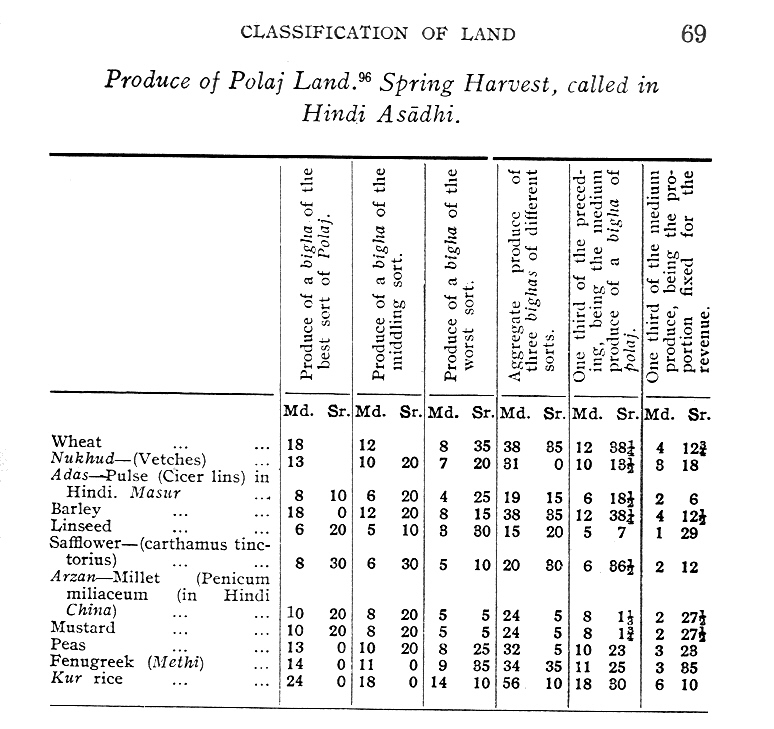

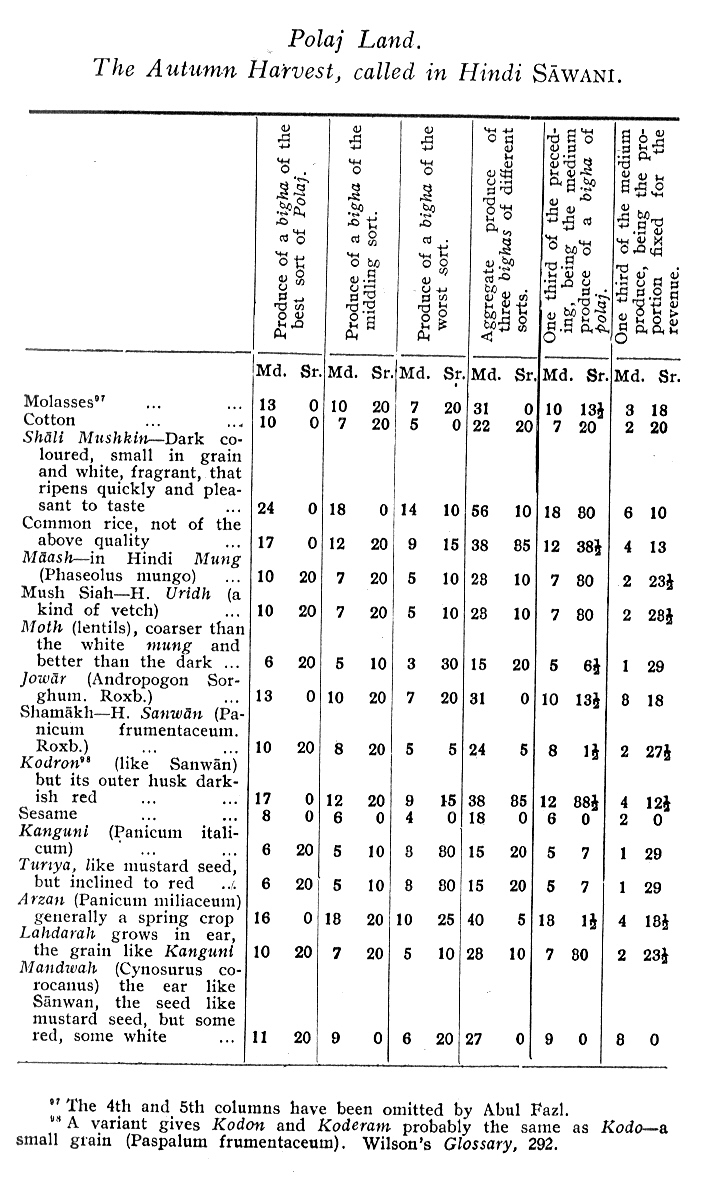

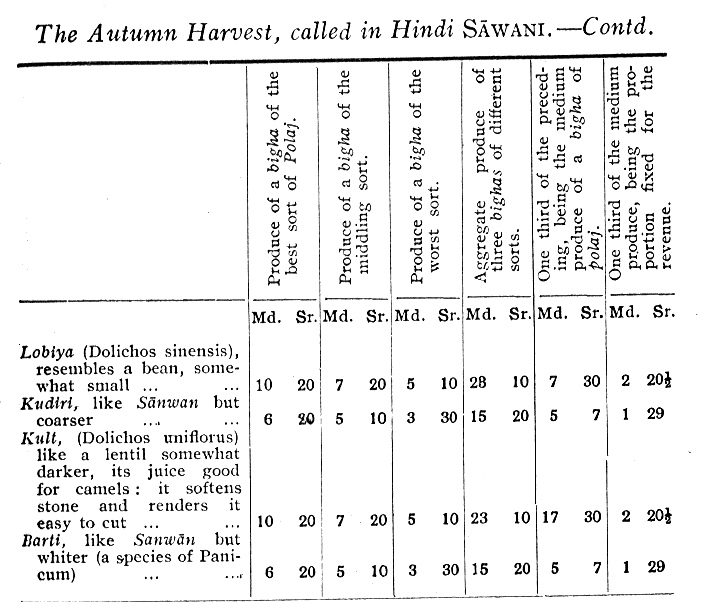

Of the two first kinds of land, there are three classes, good, middling and bad. They add together the produce of each sort, and a third of this represents the medium produce, one-third part of which is exacted as the royal dues. The revenue levied by Sher Khān, which at the present day is represented in all provinces as the lowest rate of assessment, generally obtained, and for the convenience of the cultivators and the soldiery, the value was taken in ready money. [S. 69]

The revenue from musk melons, ajwāin (Ligusticum ajowan), onions and other greens not counted as produce, was ordered to be paid in ready money at the rates hereinafter mentioned.

[S. 71] As a consideration for watching the crops a quarter of a seer (per maund) is allowed in some places and in others more, as will be shown.

The revenue from indigo, poppy, pān, turmeric, pignut (trapa bispinosa), hemp, kachālu (arum colocasia) pumpkin, hinna (Lawsonia inermis) cucumbers, bādrang (a species of cucumber) the egg-plant (solanum melongena), radishes, carrots, karelā (momordica charantia) kakūra, tendas, and musk-melons, [S. 72] not counted as produce, was ordered to be paid in ready money at the rates hereafter mentioned.

Parauti land when cultivated, pays the same revenue as polaj.

His Majesty in his wisdom thus regulated the revenues in the above-mentioned favourable manner. He reduced the duty on manufactures from ten to five per cent. and two per cent. was divided between the patwari and the ḳānungo. The former is a writer employed on the part of the cultivator. He keeps an account of receipts and disbursements, and no village is without one. The latter is the refuge of the husbandman. There is one in every district. At the present time the share of the ḳānungo (one per cent.) is remitted and the three classes of them are paid by the State accordding to their rank. The salary of the first is fifty rupees: of the second, thirty; of the third, twenty; and they have an assignment for personal support equivalent thereto. It was the rule that the commissaries of the shiḳḳdar, karkun, and Amin should receive daily 58 dāms as a perquisite, provided that in spring they did not measure less than 200, nor in autumn less than 250 bīghas. His Majesty whose heart is capacious as the ocean, abolished this custom and allowed only one dām for each bīgha.

Many imposts, equal in amount to the income of Hindustān were remitted by His Majesty as a thank-offering to the Almighty. Among these were the following:

The capitation tax, jizya

The port duties, mir-bahari

Tax per head on gathering at places of worship, kar

A tax on each head of oxen, gāo-shumāri

A tax on each tree, sar-i-darakhti.

Presents, peshkash.

Distraints, qurq.

A tax on the various classes of artificers, peshawar.

Dārogha's fees, dāroghānah.

Taḥsildār's fees, tahsildāri.

Treasurer's fees, fotahdāri. [S. 73]

Complimentary offerings on receiving a lease and the like, salāmi.

Lodging charges, wajih kirāya.

Money bags, kharitah.

Testing and exchanging money, sarrāfi.

Market duties, hāsil-i-bāzār.

Sale of cattle; also on hemp, blankets, oil, raw hides, weighing, scaling; likewise butcher's dues, tanning, playing at dice, passports, turbans, hearth-money, fees on the purchase and sale of a house, on salt made from nitrous earth, on permission to reap the harvest, felt, manufacture of lime, spirituous liquors, brokerage, catching fish, the product of the tree A´l (Morinda citrifolia); in fine all those imposts which the natives of Hindustān include under the term Sair Jihāt, were remitted.

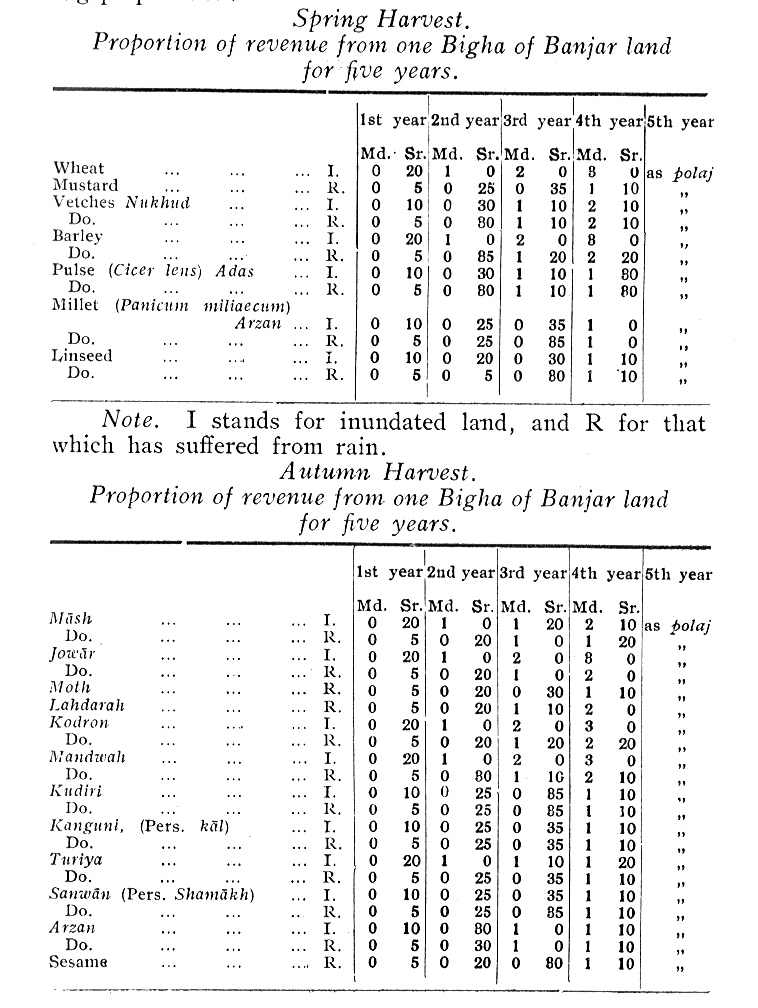

When either from excessive rain or through an inundation, the land falls out of cultivation, the husbandmen are, at first, in considerable distress. In the first year, therefore, but two fifths of the produce is taken: in the second three-fifths; in the third, four-fifths and in the fifth, the ordinary revenue. According to differences of situation, the revenue is paid either in money or in kind. In the third year the charges of 5 per cent. and one dām for each bīgha are added. [S. 73]

When through excessive inundations production has seriously diminished, the revenue is collected in the following proportions:

[S. 75] In the 4th year the charges of 5 per cent. and one dām for each bīgha were collected and this is still in force.

In Banjar land for the 1st year, one or two sers are taken from each bīgha; in the 2nd year, 5 sers; in the 3rd year, a sixth of the produce; in the 4th year, a fourth share together with one dām: in other years a third suffices. This varies somewhat during inundations. In all cases the husbandman may pay in money or kind as is most convenient. Banjar land at the foot of the hills and land subject to inundations in the districts of

Sanbal and Bahrāich, do not remain as banjar, for so much new soil is brought down with the overflow that it is richer and more productive than polaj. His Majesty, however, in his large munificence places it in the same class. It is in the option of the cultivator to pay in ready money or by kankūt or bhaoli.

Intelligent people have from time to time set themselves to record the prices current of the Empire, and after careful inquiry the valuation of grain was accepted on this basis.

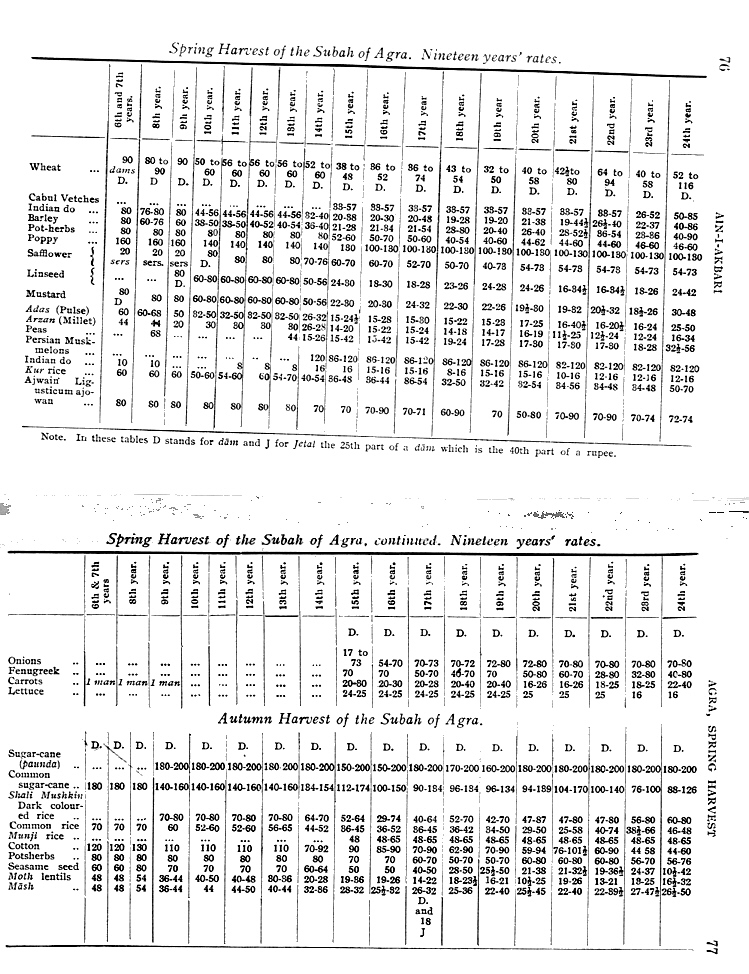

The revenue rates for a bīgha of polaj land were fixed as has been stated. From the 6th year of the Divine Era which runs with the Novilunar year 968 (A. D., 1560-1) and concluding with the 24th year of this reign, the statistics were collected and have been tabulated for reference after the most diligent investigation. The figures are entered under the heading of each year.

Note. In these tables D stands for dām and J for Jetal the 25th part of a dām which is the 40th part of a rupee.

Es folgen noch zahlreiche weitere Tabellen, die man in der Originalübersetzung einsehen kann.

Zu: 7. Zum Beispiel: Abū 'l-Faẓl ibn Mubārak <1551 - 1602> (ابو الفضل): Ā’īn-i-Akbarī (آئین اکبری), III.15 <Auszug>